3.1 Financing Housing

How Do You Finance Affordable Housing?

The private market is generally unable to produce multifamily rental housing units that rent at levels affordable to lower-income households without an infusion of public subsidy.

Watch this video on multifamily affordable housing financing.

Here is a summary of key takeaways from the video. Click on each question to see the answer.

Multifamily rental housing is financed through a combination of equity and debt. This is analogous to how an individual finances the purchase of a home. Equity is similar to a down payment in providing lenders with a cushion that reduces the risk of lending; equity comes from investors who contribute money toward a project. Debt (in the form of one or more loans from a lender) plays a role similar to a home mortgage in covering the balance of the development costs. For a fully market-rate rental property, equity and debt cover the total development costs of the property without the need for any explicit public subsidy.

Rental housing also has operating costs, like insurance, utilities, property management, security, and administrative expenses; those expenses and the development’s monthly loan payments are paid for with the revenue produced by tenants’ rent payments.

The amount of debt that a multifamily property can support depends on the level at which the rents are set. The higher the rents, the more debt the property can support. Rents that are affordable to lower-income households generally cannot support a high enough level of debt to fully cover (along with the invested equity) the costs of developing the property, leading to a gap that must be filled in order for a dedicated affordable multifamily rental property to be developed.

Developers generally use the fewest subsidy sources possible because each additional source makes a project’s funding more complex and often adds to the development’s timeline. For example, each subsidy comes with its own set of legal restrictions. To reach the lowest-income families with the greatest needs, however, developers often need to cobble together multiple sources to make the development financially feasible.

A development cannot feasibly be constructed unless 100 percent of its funding gap is covered, so every source matters. For example, a small local contribution can be the critical investment that makes a large development financed by Low-Income Housing Tax Credits work, allowing it and the surrounding community to benefit from a large federal subsidy that would otherwise go elsewhere.

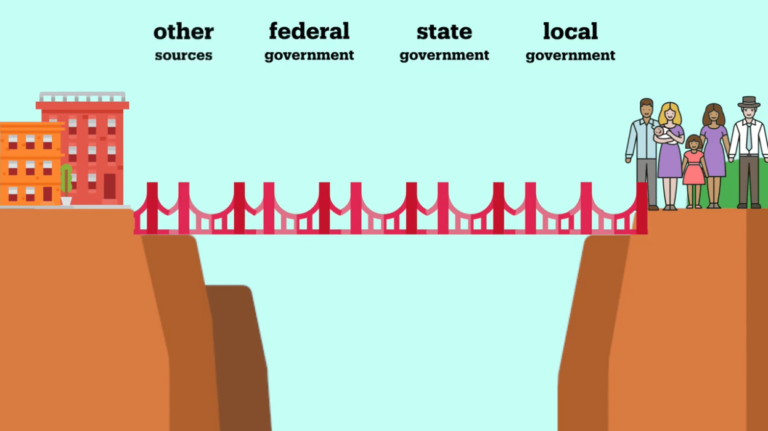

To bridge the funding gap, developers usually need help in the form of a subsidy from the local, state, or federal government that can cover a portion of the construction or operating costs. Depending on the income levels that a property seeks to serve, an additional subsidy may also be needed to cover a portion of the tenant’s rent payment.

Watch this video on the affordable housing “funding gap.”

Tools Typically Used to Fill Funding Gaps

As described in the video, a combination of funding sources is often used to assemble the full funding package needed to allow a dedicated affordable multifamily rental development to be developed. Most dedicated affordable multifamily rental properties developed today in the U.S. rely on equity contributed by syndicators in exchange for Low-Income Housing Tax Credits allocated to the property by a state or local housing finance agency.

The dedicated affordable multifamily rental property will also generally have access to debt in the form of a mortgage at a level determined by the expected rents, which are based on the target income levels of the future occupants. In some cases, this debt plus the equity from Low-Income Housing Tax Credits will be enough to allow a property to be developed, but generally, there’s still a funding gap that needs to be filled through grants or soft debt — a loan on which no regular payments are due in the near term. A standard loan, by contrast, is sometimes known as hard debt.

To see examples of hard debt, soft debt, equity, grants, and other subsidies, click on each source type.

- Low Income Housing Tax Credit (most common and largest subsidy source)

- Federal Historic Tax Credit

- State Tax Credits

- State Historic Tax Credits

- Investor/Developer Equity (i.e., down payment)

- State grants, energy funds, loan funds, and tax incentives

- Land donations

- HOME Investment Partnerships Program

- Community Development Block Grant Program

- Deferred developer fees

- Federal Home Loan Banks’ Affordable Housing Program

- Local grants

- National Housing Trust Fund

- Philanthropic foundations

Financing Housing Development

Let’s learn about the costs that need to be financed to develop a multifamily rental development and the potential sources of funding to cover those costs. Start by pulling the orange bar down on the far-left building to reveal some of costs involved in constructing a development. Then pull the orange bar down on the middle building to see how market-rate developers cover those costs. Finally, pull the orange bar down on the far-right building to see the creative ways in which developers of affordable multifamily properties cobble together the funding needed to cover their costs.