2.2 Production Obstacles

Why Doesn’t the Housing Market Produce More Housing?

Rents and home prices are affected by housing supply and demand. When housing supply is constricted and demand is steady or rising, home prices and rents tend to rise. By contrast, new development — even the development of housing for middle- and higher-income households — can help moderate the rents and home prices throughout the market as existing property owners reduce housing prices to compete more effectively against the new units coming online.

In high-cost regions — and increasingly, in many other regions as well — the market simply isn’t producing enough housing to keep pace with demand.

Watch this video on housing supply shortages.

Here are some of the key points we hope you took from this video. Click each of the boxes to learn more.

Home prices in many regions have risen faster than incomes for the last few decades. This is true not only in places like San Francisco, Boston, New York, and Los Angeles but also in Miami, Minneapolis, and Pittsburgh. As a result, housing is taking a bigger chunk of residents’ incomes.

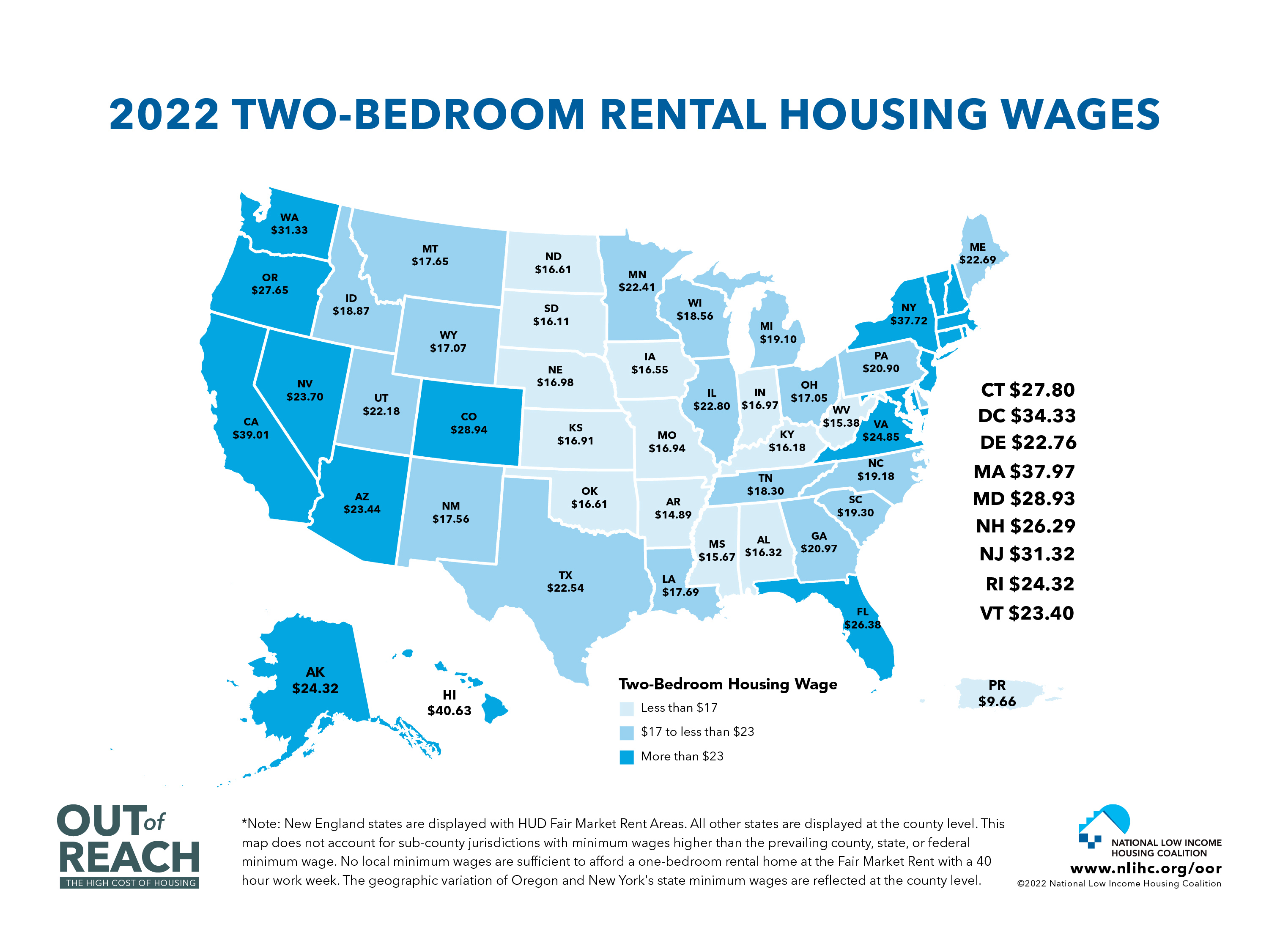

The National Low Income Housing Coalition’s Out of Reach report shared the following map illustrating the hourly wage someone needed in 2022 to afford a two-bedroom apartment in their state.

A key reason this is happening is that the supply of housing in these cities is not keeping pace with rising demand. There are many reasons why the market is not working effectively in these areas, including delays between when demand rises and when new housing can be completed, the limited availability of land on which to build, and consolidation in the homebuilding industry that has limited the number of developers working to build housing. Housing is also an unusual good in that it lasts a long time and is very expensive to build, making housing markets more difficult to fix than, let’s say, the market for cocoa powder or ketchup.

One explanation for rising housing prices is that it’s getting harder and harder to secure the regulatory approval needed to build new housing. Roadblocks in the construction approvals process make it hard for builders and developers to create enough new homes to respond to rising demand.

One roadblock can be outdated regulatory limits on the number of homes that may be built in a given space. When a developer is only allowed to build 40 units on a parcel, rather than 80 units, the supply of housing is constricted, which makes it harder for the market to keep pace with demand, leading to higher rents and home prices.

Other roadblocks include cumbersome development processes that increase the length of time and cost of getting approval from the city to begin construction and high impact fees that are intended to cover the cost of new roads and schools but also add to development costs.