Accessory dwelling units

Acquisition and operation of moderate-cost rental units

Activation of housing finance agency reserves

Appraisal gap financing

Asset building programs

Assistance for home safety modifications

Below-market financing of affordable housing development

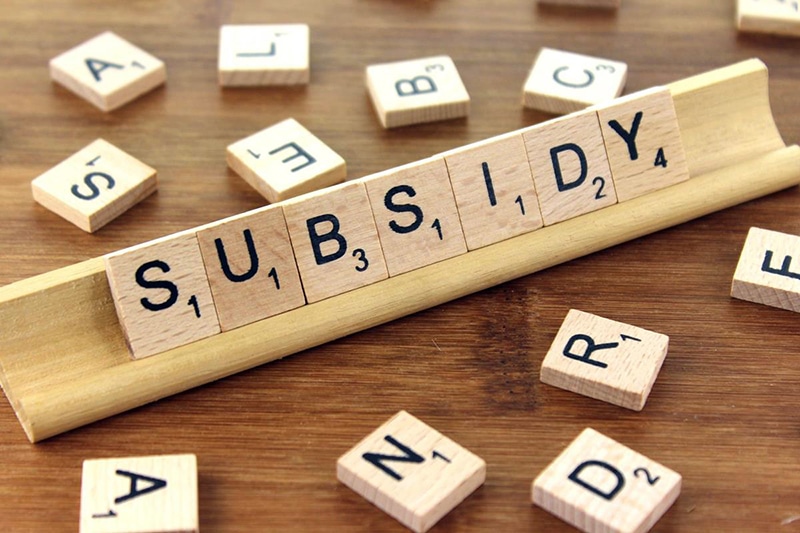

Capital subsidies for building affordable housing developments

Code enforcement

Community land trusts

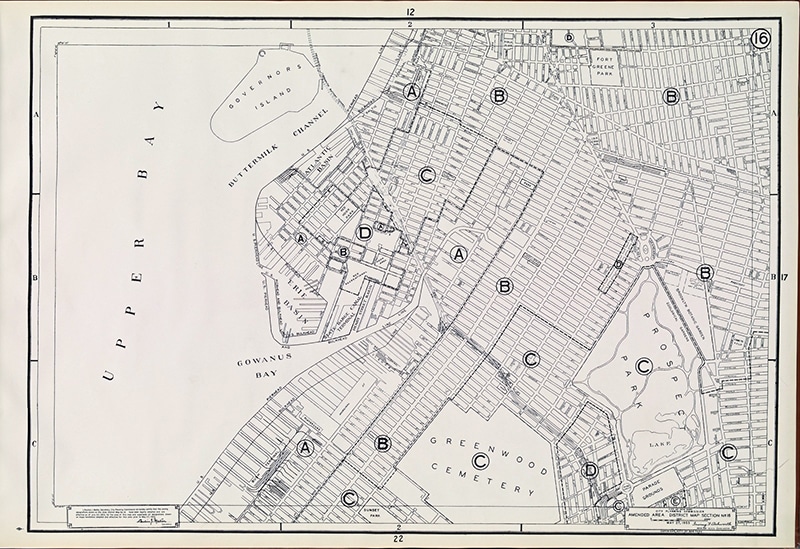

Creating and managing vacant property inventories

Dedicated revenue sources

Deed-restricted homeownership

Demolition taxes and condominium conversion fees

Density bonuses

Discounted sales of city-owned property

Employer-assisted housing programs

Energy-efficiency retrofits

Enforcement of fair housing laws

Expanded access to capital for owners of unsubsidized affordable rental properties

Expedited permitting for qualifying projects

Fair housing education for real estate professionals and consumers

Floodplain buyouts

Foreclosure and disposition of tax-delinquent properties

Foreclosure prevention programs

General obligation bonds for affordable housing

Guidance for small, market affordable rental properties

Home repair and homeowner rehabilitation assistance programs

HOME tenant-based rental assistance

Housing and building codes

Housing education and counseling

Housing trust funds

Incentives to encourage the development of lower-cost housing types

Inclusionary zoning

Insurance against property value decline

Joint development on land owned by transit and other agencies

Land banks

Landlord recruitment and retention

Lead abatement

Legal assistance for victims of discrimination

Limited equity cooperatives

Linkage fees/affordable housing impact fees

Manufactured housing and manufactured home communities

Mobility counseling for housing choice voucher holders

Operating subsidies for affordable housing developments

Opportunity Zones

Preservation inventories

Property acquisition funds

Reduced or waived fees for qualifying projects

Reductions in impact fees and exactions

Regional collaboration to support the development of affordable housing in resource-rich areas

Regulating short-term rentals

Rent regulation

Rental registries

Residential development on faith-owned land

Rights of first refusal

Security deposit and/or first and last month’s rent assistance

Shared appreciation mortgages

Source of income laws

Special Purpose Credit Programs

Stabilizing high-poverty neighborhoods through a mixed-income approach

State or local funded tenant-based rental assistance

Targeted efforts to create and preserve dedicated affordable housing in resource-rich areas

Tax abatements or exemptions

Tax incentives for new construction and substantial rehabilitation

Transfers of development rights

Use of publicly owned property for affordable housing

Weatherization assistance

Zoning changes to facilitate the use of lower-cost housing types