August 13, 2024

By Nora Carrier

Overview

Every summer, millions of Americans vacation in popular seasonal destination towns across the U.S., particularly on the coasts. Similarly, mountain towns see a boom in seasonal tourism during the winter. These places offer scenic views of nature, entertainment, and popular dining establishments. But as they become hotspots, the influx of tourists to these areas leads to an extreme surge in demand for housing during peak vacation months. And while it’s true that tourism provides significant benefits to local economies, it can also strain housing supplies, as short-term rentals and second-home purchases price local workers out of the area and leave much-needed seasonal workers struggling to find low-cost housing. Because of these challenges, municipalities that see high levels of seasonal tourism must prioritize the development of safe and affordable housing for both year-round residents and temporary workers.

The problem

Episodic housing demand has long been a concern for communities with high levels of seasonal tourism. Recent post-COVID home sales have exacerbated this challenge. Vacation home sales surged by 16.4 percent in 2020, outpacing construction growth and straining housing supply, leading to dramatic price increases.

For example, in Ocean City, NJ, median home prices rose from $548,000 in January 2020 to $1.2 million in January 2024. Similarly, median home prices rose from $351,000 to $620,000 in Barnstable, MA, on Cape Cod; from $490,000 to $780,000 in Naples, FL; and from $672,000 to $1.2 million in Steamboat Springs, CO over the same time period.

In many cities and towns, housing affordability is hindered by out-of-town home purchases and seasonal demand for housing. A 2021 study on out-of-town homebuyers used a model to show how an increase in out-of-town home purchases can significantly reduce affordability, especially for renters, particularly in areas where it’s challenging to build more housing.

Examples

In Martha’s Vineyard, MA, year-round residents have long adapted to the seasonal housing crunch by practicing what’s known on the island as the “Vineyard Shuffle.” This ingrained practice is indicative of widespread housing insecurity and involves residents relying on partial-year leases that are affordable during the winter months, but out of reach in the summer.

In high-cost vacation areas like the Hamptons, in Long Island, high housing costs have led to a shortage of local workers who can afford to live in the area. A report from 2022 revealed that a quarter of households in East Hampton, NY, spend more than half of their income on housing.

Unaffordable housing affects both seasonal and year-round workers, pushing some to extreme measures. Migrant workers who are employed in the construction trades in the area, for example, have been reported to resort to living in makeshift camps in wooded areas when they can’t afford rooms. Tragically, in December of this year, a carpenter from Guatemala residing in a Hamptons encampment was killed by a car while trying to cross a road.

In Cape Cod, MA, recent construction on the Sagamore Bridge–which connects the Cape to mainland Massachusetts–highlighted the increasing challenge of housing costs for workers on the Cape. The percentage of workers commuting into the Cape has increased in recent years, from 25 percent of the Cape’s workforce in 2017, to close to 50 percent in 2020, according to the Cape Cod Chamber of Commerce. When the Massachusetts Department of Transportation closed one lane of the Sagamore Bridge for repairs, drivers were lined up for hours in the early morning, leading to long commutes for workers heading to the Cape.

Small summer cottages in Oak Bluffs, on Martha’s Vineyard, off the Cape Cod coast of Massachusetts. This destination is one of the island’s main points of arrival for summer visitors. Image credit: Getty Images

Solutions for communities

While housing becomes acutely unaffordable in vacation towns, cities and towns are implementing new strategies to fund, build, and preserve housing that locals and seasonal workers can afford.

Funding affordable housing

Real estate transfer taxes

In cities and towns with high-cost second-home markets, real estate transfer taxes can be a useful source of revenue for municipalities. Funds from these taxes can be used for various affordable housing initiatives. Real estate transfer taxes can be progressive, meaning that they only apply to sales of homes over a certain price threshold.

According to an Institute on Taxation and Economic Policy brief, 17 cities and counties have enacted progressive taxes on high-value real estate sales. The authors argue that when funds are applied towards housing programs, these taxes have the potential to reduce wealth gaps and advance equity in housing. The authors cite Santa Fe, NM, where voters enacted a three percent tax on single-family residential property sold for over $1 million. Revenue from this tax–estimated at $6 million per year–will go to Santa Fe’s Affordable Housing Trust Fund, building new homes for low and middle-income residents.

In Martha’s Vineyard, the Coalition to Create the Martha’s Vineyard Housing Bank–a group of vineyarders active since 2020–advocates for a real estate transfer tax whose proceeds will go towards creating affordable housing. In 2022 in East Hampton, voters approved a 0.5 percent real estate transfer tax on home sales over $400,000 that will be used to fund affordable housing initiatives. The tax is estimated to raise between $6 million and $12 million each year, depending on the pace of the local real estate market.

Short-term rental fees

Cities can also consider funding affordable housing programs through fees on short-term rentals. In many vacation areas, short-term rentals have proliferated with the popularity of booking websites like Airbnb and Vrbo. While these rentals accommodate tourists, they can strain an area’s housing supply. Some municipalities have addressed this trend through short-term rental fees, which simultaneously help local governments regulate the practice and generate revenue that can be put towards affordable housing.

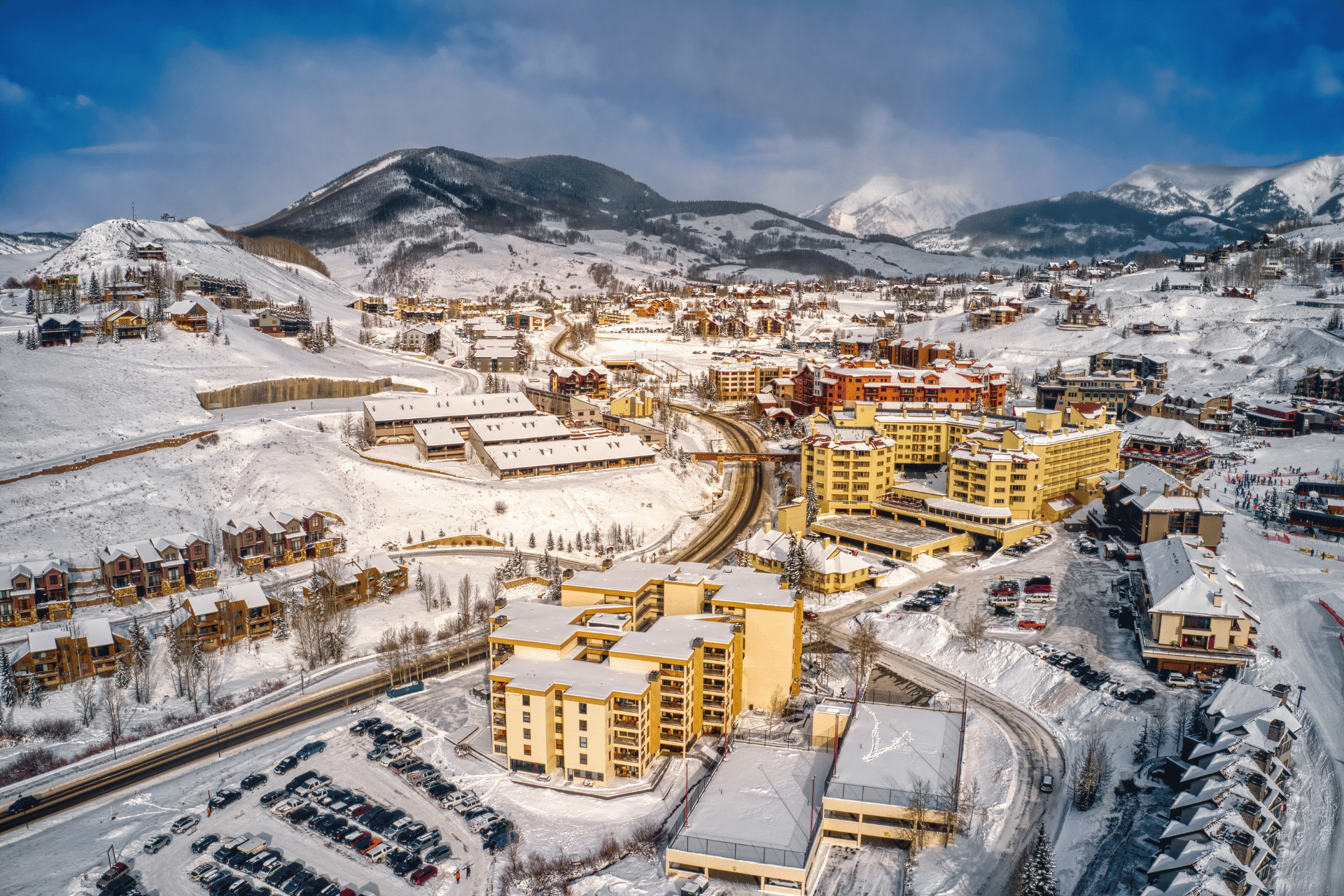

In Colorado, towns that see high tourism demands in the winter months have enacted short-term rental fees. In Breckenridge, CO, a fee of “$400/studio and/or per bedroom” was enacted in 2022. Utilizing the town’s short-term rental fee, Breckenridge committed $50 million to a workforce housing plan that aims to partner with local developers to create 970 units over five years. Workforce housing in this context refers to units that are either income-restricted to low-wage workers or are deed-restricted to low and moderate-income earners who work in Breckenridge. In Crested Butte, CO, funds from a 7.5 percent Vacation Rental Excise Tax enacted in 2021 go to the town’s Affordable Housing Fund rather than the town’s general operations.

Aerial view of Crested Butte, Colorado, a ski resort town popular with tourists in the winter months. Image credit: Getty Images

Tourist impact taxes

In Florida, certain areas are authorized by the state to enact “Tourist Impact Taxes.” This type of tax is unique to Florida and has been part of the state’s tax code for decades as a response to its large tourism industry. Monroe County, FL, home of the Florida Keys, has been implementing a Tourist Impact Tax since 1986. The tax is charged as one percent of any sales from overnight accommodations of less than six months, including on “any hotel, apartment hotel, motel, resort motel, apartment, apartment motel, roominghouse, mobile home park, recreational vehicle park, or condominium.” Half of the tax funds the Monroe County Land Authority, which is dedicated to acquiring property for conservation use, funding affordable housing projects, and maintaining conservation land stewardship programs in the county. Between 1988 and 2020, the Monroe County Land Authority helped fund 1,302 affordable housing units.

Preserving affordable housing

As seasonal and tourist demand for real estate increases against the backdrop of a limited housing supply cities and towns must take action to preserve existing housing that is affordable for low and middle-income residents.

Vail, CO–a popular ski area–preserves affordable housing through a unique deed restriction program known as InDEED. As opposed to traditional affordable deed restrictions, the InDEED program does not have a price appreciation cap for homeowners. The main requirement of the deed restriction is that it must be an individual’s primary residence, and they must work a minimum of 30 hours a week in Eagle County, CO. Vail buys deed restrictions from homeowners and prospective homeowners, who can use these funds to refinance their mortgages or put a down payment on a home. Since 2017, Vail has invested $12.5 million in this program, purchasing a total of 1,050 deed restrictions.

Orleans, MA, on Cape Cod, has a partnership with the Harwich Ecumenical Council for Housing to provide interest-free home rehabilitation loans to homeowners who earn under 80 percent of the county’s Area Median Income (AMI). Loans can be used to rehabilitate homeowner’s primary residences or to rehabilitate rental units that are “new affordable year-round rental unit(s) to house income-qualified tenants.” The emphasis on “year-round” rental units is important and highlights the need for seasonal communities like Orleans to create and preserve housing for year-round residents. “Income-qualified tenants” are also key to this program; municipalities designing similar programs must carefully consider what income levels qualify for funding.

Encouraging employers to build or fund housing

Local employers who hope to attract employees to high-cost areas have an incentive to provide housing. Municipalities can partner with or encourage employers to build or otherwise pay for their employees’ housing. There have been high-profile examples of employers building housing in vacation areas in Maine and Tennessee and legislative efforts in Massachusetts to promote such efforts.

In Bar Harbor, ME, near Acadia National Park, Friends of Acadia National Park purchased the Kingsleigh Inn, a former bed and breakfast, with plans to convert it into workforce housing for seasonal Acadia employees. The building will house ten park employees through the summer months. This project is part of a larger effort by Friends of Acadia, a non-profit organization that supports the park, and the National Park Service, to address the housing shortage in the area, with a goal of adding 130 beds for park employees over the next decade.

In Pigeon Forge, TN, Dolly Parton’s theme park Dollywood partnered with contractor Holtz Builders to build a 756-bed dormitory-style building for seasonal student-employees. Dollywood announced the project in August of 2021 and completed it in 2022. The building is designed to house international students participating in the U.S. Summer Work Travel program. In their announcement, Dollywood’s team emphasized that this development “offers a vital benefit to many seeking employment in Sevier County.”

Massachusetts has a bill that aims to encourage employer support of housing for seasonal workers. An Act to support the seasonal workforce proposes a tax credit for employers who pay rent for their employees. The tax credit paid to an individual employer cannot exceed $10,000 annually and is based on the amount of rent an employer pays. This bill has not yet become a law, but it is a promising sign of support for employer-assisted housing in a state like Massachusetts, which has several high-cost vacation destinations like Cape Cod, Martha’s Vineyard, and the Berkshires. For more information on this topic, read the Housing Solutions Lab’s Employer-assisted housing programs policy brief.

Takeaways

Overall, seasonal tourist destinations face unique challenges in providing housing for both year-round residents and seasonal employees in their communities. Accommodations for tourists and high demand for second homes can overwhelm an area’s housing supply. In response, cities across the country are funding affordable housing through innovative solutions. Strategies such as real estate transfer taxes, short-term rental fees, and tourist impact taxes can generate much-needed revenue to fund affordable housing initiatives. Additionally, preserving existing affordable housing through programs like deed restrictions and partnerships with local employers can help ensure that the workforce has access to housing. By prioritizing the development and preservation of affordable housing, municipalities can mitigate the negative impacts of seasonal tourism and support the long-term sustainability of their communities. Ultimately, policymakers should take advantage of seasonal economic activity and invest in housing for much-needed workers and community members.

Additional Housing Solutions Lab resources

For additional information about policy tools mentioned in this article, see the following resources.

Dedicated Revenue Sources. This policy brief outlines different types of dedicated revenue sources–a committed stream of revenue used for affordable housing. Real estate transfer taxes are an example of a dedicated revenue source.

Regulating Short-Term Rentals. This policy brief highlights different approaches municipalities have taken to regulate short-term rentals, and raises important considerations for cities and towns considering similar regulation.

Homeowner Rehabilitation Assistance Programs. This policy brief explains home repair programs for homeowners and highlights different approaches municipalities should consider regarding eligibility and funding when designing these programs.

2 Responses